Who We Serve

We are passionate about helping anyone who is looking to get their financial life in order. In particular, we focus on tailored solutions for business owners, retirees/pre-retirees, emerging wealth, and those undergoing major life transitions.

How We Do It

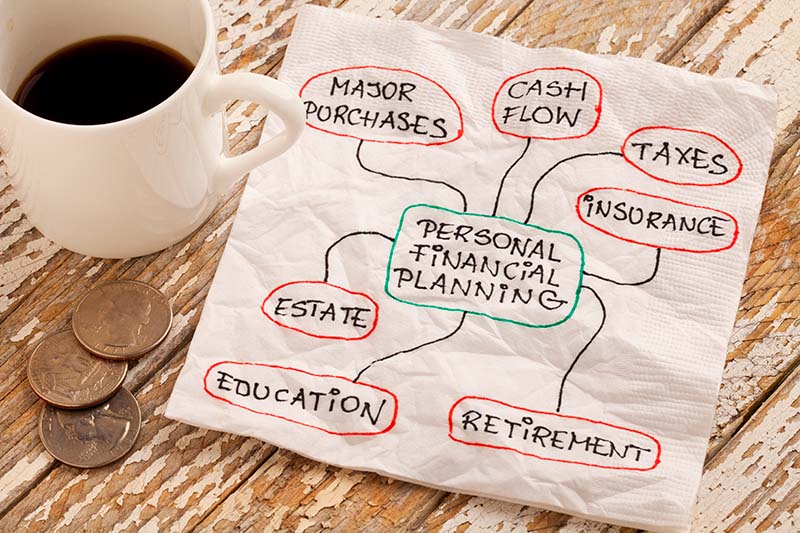

As part of our process, we assess your current financial situation, understand your unique goals and timelines, develop an investment strategy to meet those goals, and analyze the results on a regular basis. Whether it’s retirement, a major purchase, college savings, or building wealth, your investment accounts should be aligned with your customized plan and allocated according to your future needs. We provide a more comprehensive review of your financial picture than most financial advisory firms to ensure everything works together in your plan.

Financial Planning

To create a clear path forward, we build custom financial and retirement plans that provide peace of mind. Formalizing financial goals for the client is a key part of the process and projecting the probability of a successful outcome for those goals is critical to know you are on the right path.

Investment Management

We build tailored portfolios to meet the long-term goals of our clients based on risk tolerance, portfolio return, investment timeline, and tax considerations. Our portfolios are constructed of investments that include, ETFs, individual stocks, mutual funds, and more complex strategies like options and defined outcome ETFs.

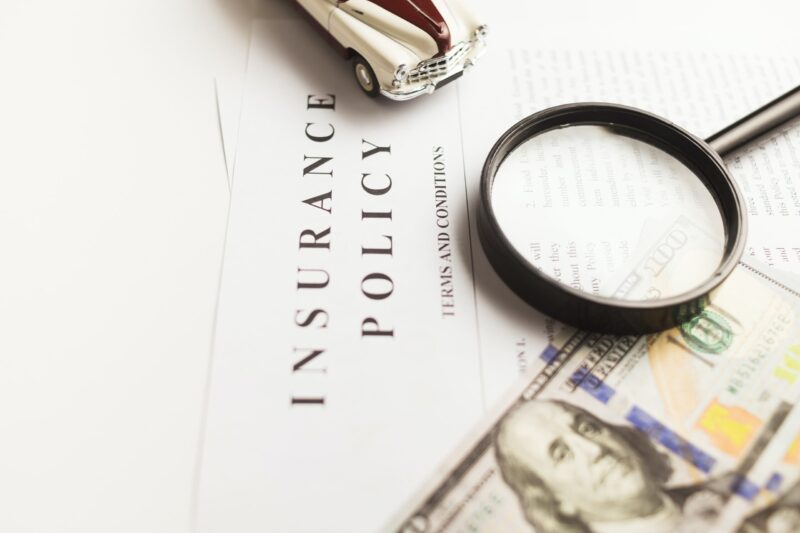

Insurance

Protecting your worth is as important as building it. We recommend and review life insurance policies to protect families from loss of income and debt coverage. We also review and recommend property and casualty insurance (home and auto) to make sure assets are properly protected and liabilities are minimized.

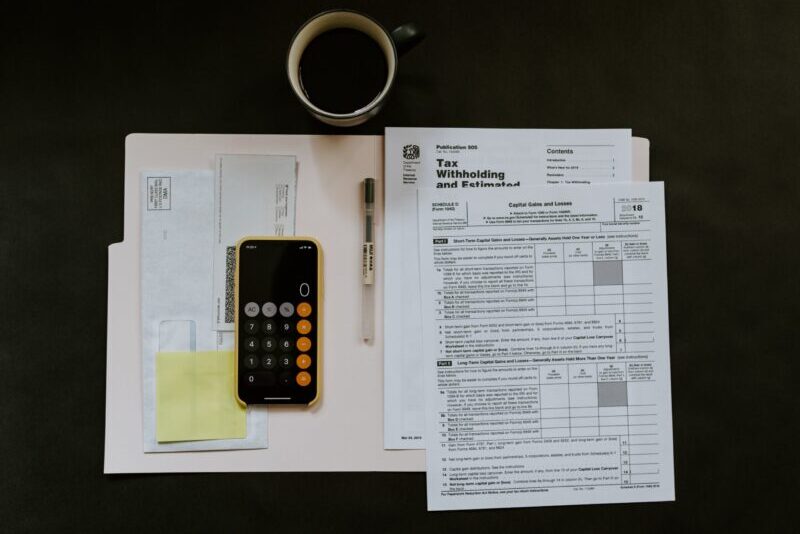

Tax Saving Strategies

Tax considerations are a significant factor in maximizing your net worth. We help our clients reduce taxes by evaluating and implementing various strategies such as exploring small business retirement plans, corporate structure for the self-employed, evaluation of account types, tax loss harvesting, and tax-sensitive investments.

Social Security Analysis

Social Security provides the majority of income for retirees. For most, benefits typically replace roughly 40 percent of income. That’s why it’s important to get it right. As a part of our planning process, we evaluate the optimal age to access social security by considering taxation, part-time employment, spousal benefits, and longevity.

Saving for Education

A child’s education is important, and because of that, it’s important to us. We can work with you on funding strategies designed to help cover some or all of those costs. Whether you are considering private K-12 or higher education, we can provide guidance to make sure you are on track to meet your needs.

FAQ’s

When done properly, investing is a long-term commitment requiring research and careful analysis. Investors should keep their emotions in check when approaching the investing arena. The decisions made in a moment of fear or a moment of fearlessness have destroyed many fortunes. It is the responsibility of a financial advisor to navigate the increasingly complex financial markets with a client’s financial plan and well-being in mind.

Farris Capital Management is an investment management firm beholden only to our clients. As a completely independent company, our compensation is derived directly from our clients. “Fee-only” means that we receive no other compensation other than the fee you pay; we do not sell products. This arrangement ensures that our recommendations are made with your best interests at heart!

In order to become a CERTIFIED FINANCIAL PLANNER™ professional, one must pass a rigorous examination covering 89 financial and legal topics, satisfying experience and education metrics, and act ethically. There is no federal or state law or regulation that requires financial planners to hold the certification.

Registered Investment Advisors are firms registered with their state of business or the Securities Exchange Commission to provide investment advice. A Registered Investment Advisor is held to a Fiduciary Standard, meaning they are expected to act in the best interest of their client at all times. As fiduciaries, an advisor must employ a policy of full disclosure with their clients to help avoid potential conflicts of interest.

The primary custodians used by Farris Capital Management are Charles Schwab and Fidelity Investments, both members of the Securities Investor Protection Corporation (SIPC). SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. For more information, go to http://www.sipc.org/

Stay In Touch